Best Online Loans for Every Situation — Fast, Easy & Secure

Get approved for online loans today! Compare payday, personal, and bad credit loan options — even with no credit. Fast cash, secure process, trusted lenders.

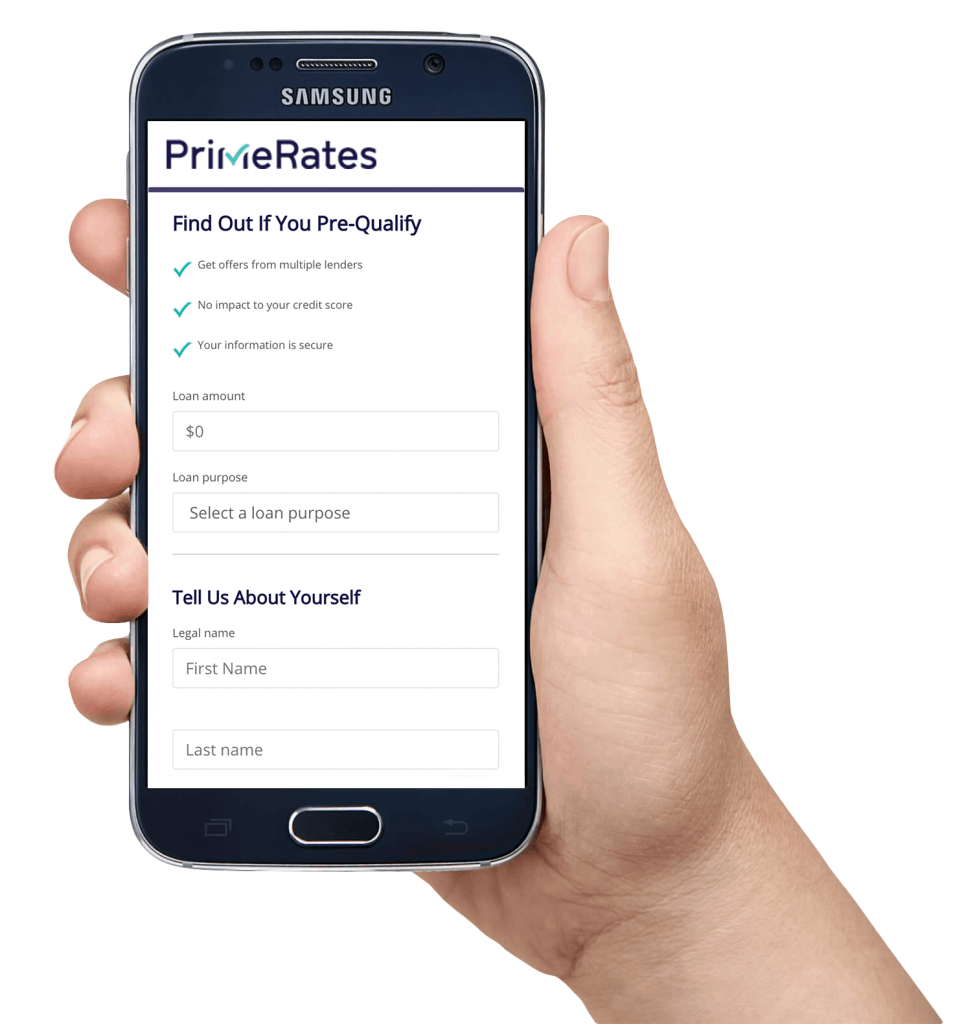

PrimeRates provides access to personalized loan offers through our simple and quick pre-qualification application. Once you’re pre-qualified, you can select the best offer for you and finalize the loan application with the lender.

1

Simple pre-qual application in less than 1 minute.

2

Choose the offer that best fits your needs.

3

Finalize your loan offer, get approved, and receive funds.

What Is ZippyLoan? ZippyLoan is an online loan-matching service that connects borrowers with personal loan options that fit a variety needs. With loans ranging from $100 to $15,000, their products can help you fund anything from smaller expenses, like utility bills or rent payments, to events which require larger amounts, such as home improvement projects or a down payment on an automobile.

ZippyLoan might be a good fit if:

|

|

| APR range: | 5.99% – 35.99% |

| Available loan terms: | Up to 5 years |

| Loan amounts: | $100 – $15,000 |

| Origination fee: | None |

| Credit needed: | All credit types accepted |

| Income needed: | No minimum income required |

| Best for: | Smaller loan amounts, those struggling with approval from direct lenders |

|

Click “Check Rates” to pre-qualify and receive a personalized rate. |

|

Interest rates: Most of the annual percentage rates for ZippyLoan range between 5.99% and 35.99%. However, due to the variety of lenders who this company works with, some of their rates may fall out of this range.

Cost: ZippyLoan’s origination, late payment, prepayment and insufficient funds fees are dependent on the lender, the amount of the loan and the borrower’s state of residence and credit score. ZippyLoan’s website does not offer information about the range of fees and costs associated with its products.

How fast can you get your money? Loans from ZippyLoan can fund as soon as the next day, depending on the product and the lender.

How to Qualify for ZippyLoan: ZippyLoan does not require a minimum credit score or annual income to be eligible for one of their loans. However, applicants should be over 18 years of age, have verifiable and regular income, have a bank account and reside within the United States.

Types of Loans ZippyLoan Offers: ZippyLoan offers unsecured personal loans of up to $15,000, with loan repayment terms of up to 60 months. A personal loan is a type of loan that is intended to cover personal expenses such as home improvement, debt consolidation, down payments and personal projects.

Loan Example: If a borrower takes out $9,000 with an interest rate of 20.2% and a loan term of 40 months, the minimum monthly payment will be $311.01.

Pros

Cons

ZippyLoan’s approval process starts with a five-minute application on their website. Before applying, you’ll want to have your financial information, address and contact information available. Their homepage is also optimized for both iOS and Android users if you decide to apply on your smartphone.

Once you complete the application, the site will process your information and provide you with offers within minutes. The offers that you will receive are based on your credit score, state of residence, verifiable income and financial history. You can then review and e-sign your loan agreement if you decide to accept any of the offers.

Before you make a final decision on a loan, it’s always wise to compare rates from a number of different lenders. Here are some additional companies you might want to consider applying to:

ZippyLoan encrypts all of the information that is sent through their website, according to the standard security protocol for online lenders. They also work with several legitimate companies and lenders.

However, there have been over 23 official complaints lodged against ZippyLoans with the Better Business Bureau. The complaints range from borrowers alleging that the platform sold their personal information to claims that ZippyLoans has charged unusually high processing fees.

They also do not list a customer service telephone number or sponsoring bank or organization.

If you need to secure a loan quickly, it’s important to grasp a few key points regarding loans from the network of lenders associated with Zippyloan.

Zippy Loan doesn’t specify a minimum or maximum credit score requirement, welcoming applications from people with a variety of credit histories. To qualify, applicants must be at least 18 years old or meet the minimum age requirement of their state, whichever is greater. Zippy loan reviews indicate that users with a wide range of credit scores have been able to obtain loans through Zippy Loans. It’s important to know that Zippy Loans isn’t issuing the loans themselves; they are connecting users with lenders.

Zippy Loans interest rates are between 6.99% and 24.99%, with some lenders providing rates as low as 2.49%. According to Credit Karma, a $15 charge per $100 borrowed over a 14-day period translates to an annual percentage rate (APR) of 391%.

When pondering “Is ZippyLoan legit?” one thing you may want to consider is the ownership of the company. Launched in 2021 by former bankers and now community-focused leaders, CEO Ben Halliday and President COO Jordan Bucy, Zippy is driven by a team of experienced professionals dedicated to increasing housing affordability. They use cutting-edge consumer lending solutions and innovative software to support today’s community home sellers.

Securing a loan to build credit through Zippy Loan can help build your credit in several ways. Consistent, on-time payments are a critical factor in credit scoring models, so by repaying a ZippyLoan as agreed, you demonstrate responsible credit behavior. This positive credit building loan repayment history can contribute to an improved credit profile over time. Additionally, managing a loan responsibly can diversify your credit mix, which is another component considered in your credit score. However, it’s essential to confirm that the lender does report to credit bureaus. Some of the lenders in ZippyLoan’s network provide this service.

Funds Available Tomorrow – If you’re trying to cope with overdue bills, facing unforeseen costs, or just want to plan a getaway vacation Zippyloan offers quick loans and can help you meet your financial objectives promptly. After you match with a lender from our network, your funds can generally be deposited into your account by the next business day, assuming your application is submitted before 5pm CST.

ZippyLoans provides one of the fastest lending experiences in the industry. With an online application that takes just a few minutes and loans that can fund as soon as the next business day, this service is one that might be a good idea to consider if you’re looking for fast cash.

Additionally, they work with a large variety of lenders so borrowers with average to poor credit have higher chances of finding a product that they’re approved for. Their APRs typically fall within a reasonable range so applicants can be fairly certain that they won’t be charged extremely high interest rates.

However, this service does lack a few things like a customer service number and a list of its affiliate lenders. It might be a good idea to apply with some of its competitors which openly list this information, in order to ensure a transparent borrowing experience.

Get approved for online loans today! Compare payday, personal, and bad credit loan options — even with no credit. Fast cash, secure process, trusted lenders.

Learn if no credit check loans are safe, understand their risks, and get tips to avoid costly mistakes. Make informed financial decisions with expert guidance.

Looking for personal loans for bad credit? Learn how to get approved, compare interest rates, and find lenders who work with lower credit scores.

Learn how to use visa gift card online with our complete guide. Follow step-by-step instructions to shop confidently and maximize your card’s value.

Want to buy someone the perfect gift this holiday season? Look no further than a gift card. Here’s a breakdown of different types of gift cards you can get.

Wondering how to get a credit card for bad credit? A number of card issuers are offering great options. Here’s how to land a card that fits your situation.