Best Online Loans for Every Situation — Fast, Easy & Secure

Get approved for online loans today! Compare payday, personal, and bad credit loan options — even with no credit. Fast cash, secure process, trusted lenders.

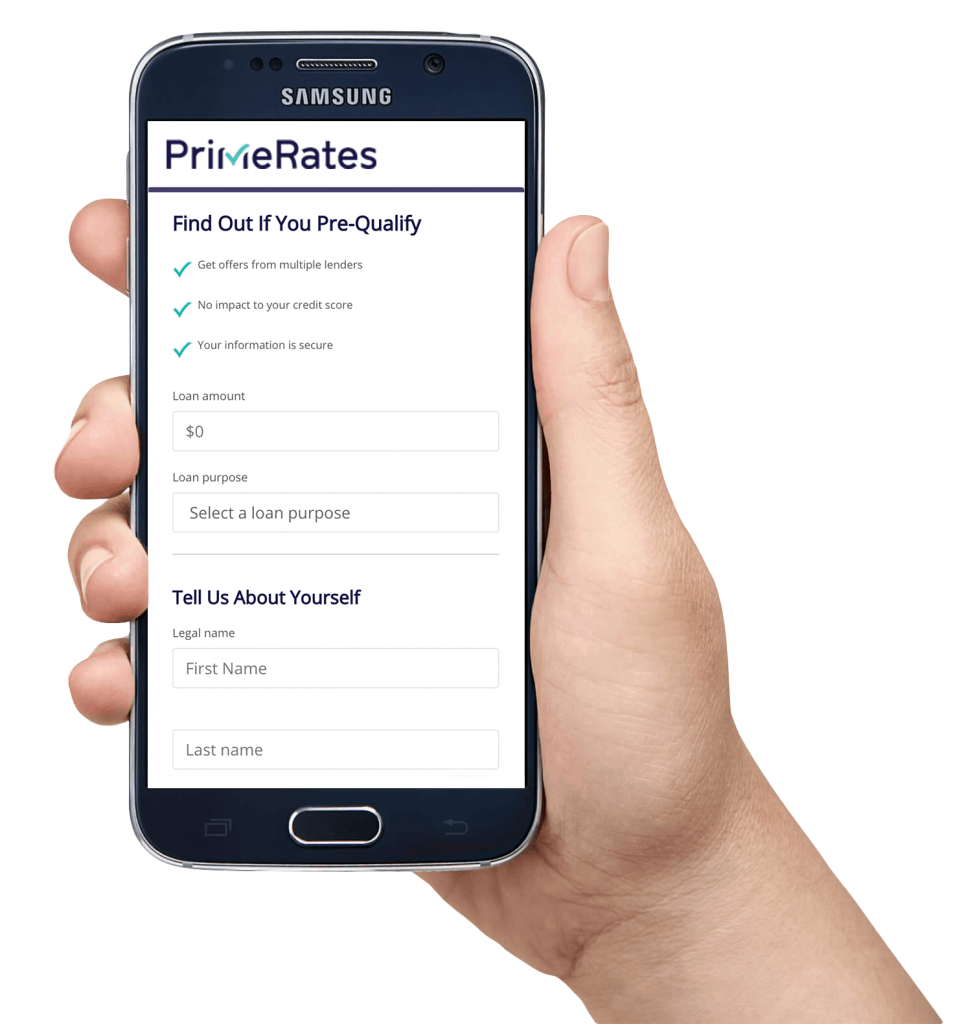

PrimeRates provides access to personalized loan offers through our simple and quick pre-qualification application. Once you’re pre-qualified, you can select the best offer for you and finalize the loan application with the lender.

1

Simple pre-qual application in less than 1 minute.

2

Choose the offer that best fits your needs.

3

Finalize your loan offer, get approved, and receive funds.

A personal loan of up to $25,000 can be used to finance emergency expenses, vehicle down payments, major home repairs, medical expenses or consolidate debt. Because this is a mid-sized personal loan, it’s easier for borrowers who fall short of having excellent credit to qualify than with a larger loan.

In simplest terms, an LLC business loan is essentially a partnership that can deliver cash quickly. Online lenders can match business owners and help them grow, manage, or start their business.

You have a few options when it comes to applying for an LLC business loan including:

Similar to most business loans an LLC business loan typically requires documentation including:

If you can provide the documentation listed above you may be eligible for an LLC business loan. In addition, you must be a registered business for a minimum of 4 months and have an active business bank account.

There are many ways you can obtain a personal loan to grow or launch your LLC, thus making it a competitive option.

Pros

Cons

LightStream offers competitive financing options for LLC business loans. They are a credible national lender that operates online as a division of SunTrust Bank.

Pros

Cons

LendingClub offers peer-to-peer lending options with fast approval and reasonable interest rates. Peer-to-peer lending connects people with money to people who need to borrow money.

Pros

Cons

Working with SoFi can be an attractive option for an LLC business loan if you have good credit.

Pros

Cons

In 2006, Prosper was one of the first companies to introduce marketplace lending and is still thriving with their model today. Prosper has funded over $5 billion in loans and targets people with fair to excellent credit.

Pros

Cons

Similar to LendingClub, UpStart is a peer-to-peer lending company that can provide financing for LLC business loans. UpStart may be a good choice for applicants with little to no credit history, steady income, and quality education.

Pros

Cons

When looking for a 25,000 loan, your best options depend on your credit score, income, and financial history. Here’s a primer on what to consider for securing such a loan, keeping in mind that prime rates are the interest rates that commercial banks charge their most creditworthy customers, which can serve as a benchmark for various loans but may not directly apply to personal loans, as these often have higher rates based on risk factors including creditworthiness:

Online Lenders: Many online lending platforms offer personal loans with competitive interest rates, especially if you have a good to excellent credit score. They can be more flexible than traditional banks, with quicker application processes and faster funding times. Rates vary widely based on creditworthiness, with APRs (Annual Percentage Rates) for good credit often ranging from around 6% to 36%.

Banks: Traditional banks may offer personal loans to existing customers with good credit histories. Rates may be competitive for those with excellent credit, and having a relationship with the bank can sometimes secure you a better rate or terms. Banks may offer rates slightly above the prime rate for personal loans, depending on your credit score and other factors.

Credit Unions: Credit unions often offer lower rates than banks because they are member-owned and not-for-profit. To apply, you’ll likely need to become a member. Rates can be more favorable, especially for members with good credit, and they may be more willing to consider your overall financial picture beyond just your credit score.

Peer-to-Peer (P2P) Lenders: P2P platforms connect borrowers with individual investors who fund loans. Rates can be competitive for borrowers with good credit scores, and the application process is usually straightforward.

Cosigned or Secured Loans: If your credit isn’t great, consider applying for a loan with a cosigner who has better credit, or opt for a secured loan where you put up collateral. Both options can help you qualify for a loan or get a better rate.

Getting a 25k personal loan isn’t inherently hard, but it depends on your financial situation and the lender’s requirements. Here are considerations that can affect your ability to secure a $25K loan:

Credit Score: A high credit score indicates to lenders that you’re a low-risk borrower, which can make it easier to obtain a loan with favorable terms. Generally, a score of 670 or higher is considered good, but some lenders may approve loans for those with lower scores, albeit at higher interest rates.

Income: Lenders will look at your income to ensure you have the means to repay the loan. You’ll need to provide proof of income through pay stubs, tax returns, or other financial documents.

Debt-to-Income Ratio: This ratio measures your monthly debt payments against your gross monthly income. A lower ratio shows lenders you’re not overextended and are more likely to manage additional debt. A ratio below 36% is preferred, though some lenders may have more flexible requirements.

Employment History: A stable employment history reassures lenders of your ability to repay the loan. Frequent job changes or gaps in employment can be red flags.

Purpose of the Loan: Some lenders may inquire about the purpose of the loan. Certain uses, such as debt consolidation or home improvement, might be viewed more favorably than others.

Lender’s Terms: Different lenders have varying criteria for loan approval and interest rates. It’s essential to shop around and compare offers from multiple lenders, including banks, credit unions, and online lenders.

If you have a good credit score, stable income, a reasonable debt-to-income ratio, and a clear purpose for the loan, you should be able to secure a $25,000 personal loan. If your financial profile is less than ideal, you may still be able to obtain a loan but should expect higher interest rates or more stringent repayment terms.

Taking out a personal loan of $25,000 involves steps to ensure you get the best terms and rates possible. Here’s a guide to navigate this process:

Check Your Credit Score: Your credit score is a crucial factor in determining your eligibility for a loan and the interest rate you will be offered. Higher scores typically qualify for lower rates. You can check your score through credit bureaus or free credit score services online.

Assess Your Financial Situation: Understand your financial health beyond just your credit score. Consider your income, debts, and monthly expenses to ensure you can comfortably afford the monthly loan payments. Use a loan calculator to estimate your payments based on different interest rates and terms.

Research Lenders: Look into various types of lenders, including online lenders, banks, and credit unions. Each type of lender offers different advantages, and you’ll want to find the one that best suits your needs in terms of interest rates, loan terms, and fees.

Compare Loan Offers: Apply for pre-qualification with multiple lenders if possible. Pre-qualification often involves a soft credit check, which doesn’t affect your credit score and can give you an idea of the loan amount, rate, and terms you might qualify for. Compare these offers to find the best one.

Read the Terms Carefully: Once you have a few offers, read the terms carefully. Look beyond the interest rate and monthly payment to understand fees (origination fees, late fees, prepayment penalties) and the flexibility of terms.

Formally Apply: Once you’ve chosen the best offer, proceed with the formal application process. This will typically require a hard credit check, which can temporarily affect your credit score. You’ll need to provide documentation that verifies your income, employment, and identity.

The credit score needed for a 25000 personal loan can vary depending on the lender and the type of loan you’re applying for. Here’s a general guideline:

Excellent Credit (720 and above): With an excellent credit score, you’re likely to qualify for a $25,000 loan with most lenders and receive favorable interest rates and terms.

Good Credit (670 to 719): A good credit score should also enable you to secure a $25,000 loan, but the interest rates might be slightly higher compared to those with excellent credit.

Fair Credit (580 to 669): It’s possible to get a $25,000 loan with a fair credit score, but your options will be more limited. Lenders that cater to borrowers with fair credit may charge significantly higher interest rates.

Poor Credit (below 580): Obtaining a $25,000 loan with poor credit is challenging but not impossible. You may need to look into lenders that specialize in bad credit loans, secure a co-signer, or explore alternative lending options. Be prepared for higher interest rates and less favorable terms.

Lenders consider more than just your credit score when evaluating a loan application; your income, employment history, debt-to-income ratio, and the purpose of the loan are also evaluated.

PrimeRates offers a streamlined process to discover personalized loan options with our quick and easy pre-qualification application. After you’ve pre-qualified, you can choose the offer that suits your needs and complete the loan application directly with the lender.

Get approved for online loans today! Compare payday, personal, and bad credit loan options — even with no credit. Fast cash, secure process, trusted lenders.

Learn if no credit check loans are safe, understand their risks, and get tips to avoid costly mistakes. Make informed financial decisions with expert guidance.

Looking for personal loans for bad credit? Learn how to get approved, compare interest rates, and find lenders who work with lower credit scores.

Learn how to use visa gift card online with our complete guide. Follow step-by-step instructions to shop confidently and maximize your card’s value.

Want to buy someone the perfect gift this holiday season? Look no further than a gift card. Here’s a breakdown of different types of gift cards you can get.

Wondering how to get a credit card for bad credit? A number of card issuers are offering great options. Here’s how to land a card that fits your situation.